For example, hair stylists at a salon who perform haircuts and other services are considered direct labor while the maintenance staff and the receptionist who support them are indirect labor. Labor costs refer to remuneration paid to the employees by the business in the form of wages, salary bonus, allowances etc. for their time and effort. Of the total amount, the company needs to account for the payroll taxes of $15,000 while the rest of $85,000 will go to the wages payable. A more likely outcome is that the applied overhead will not equal the actual overhead. The following graphic shows a case where $100,000 of overhead was actually incurred, but only $90,000 was applied. In addition to these steps, we could also note that our accounts payable and wages payable liability accounts still have a balance of 51,500.

Looking To Get Started?

If the employee’s work can be directly tied to the product, it is direct labor. If it is tied to the marketing department, it is a sales and administrative expense, and not included in the cost of the product. Indirect materials also have a materials requisition form, but the costs are recorded differently. They are first transferred into manufacturing overhead and then allocated to work in process. The entry to record the indirect material is to debit manufacturing overhead and credit raw materials inventory. Ethics and the Manager LO3-4Terri Ronsin had recently been transferred to the Home Security Systems Division of National Home Products.

Typical Job Cost Accounting Journal Entries

These support workers perform tasks that are integral to the operation of the business but not directly tied to the manufacturing of the finished product. Indirect labor records are also maintained through time tickets, although such work is not directly traceable to a specific job. The difference between direct labor and indirect labor is that the indirect labor records the debit to manufacturing overhead while the credit is to factory wages payable.

- Highly skilled and motivated workers exhibit enhanced efficiency and contribute towards controlling and reducing the total direct labor cost of the entity.

- A more likely outcome is that the applied overhead will not equal the actual overhead.

- Instead, it will divide the cost of the building by a small whole number such as 3 or 5 and expense the building by that fraction over the next 3 or 5 years.

- More specifically, these labor costs are included as part of the inventory asset on the balance sheet in an account called Works in Progress (WIP).

- Motion pictures, printing, and other industries where unique jobs are produced use job costing.

Transfer to labor cost to production

Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. The computation of inventory for the packaging department is shown in Figure 5.7. Start your 21-day free trial right now and discover all the features of Skynova’s all-in-one invoicing and accounting software. On the other hand, as far as Indirect Labor Costs are concerned, they are mainly fixed, regardless of output level the company is operating at.

Overhead is assignedto a job at the rate of $ 2 per machine-hour used on the job. Job16 had 875 machine-hours so we would charge overhead of $1,750 (850machine-hours x $2 per machine-hour). Job 17 had 4,050machine-hours so overhead would be $8,100 (4,050 machine-hours x$2). The journal entry to apply or assign overhead to the jobswould be to move the cost FROM overhead TO work in processinventory.

When the home is completed, the accumulated costs become part of the finished goods inventory value, and when the home is sold, the finished goods value of the home becomes the cost of goods sold. Conversion costs are the expenses (direct and indirect) that are required to convert the raw materials into finished products. Understanding indirect labor costs and how they are accounted for is essential to maintaining proper accounting records. Fortunately, Skynova offers accounting software that helps you keep track of these costs and stay on top of your business finances. The administrative indirect labor cost, on the other hand, is treated as period cost and is expensed in the period of incurrence. Personnel working in accounting, marketing and engineering departments are some examples of administrative indirect labor employees.

For example, the wages of a team of workers that performs their tasks solely on the job A can be directly traced to job A. You don’t need to modify liabilities since this is just a transfer of assets from one asset account to another. However, since employees are going to work on the raw materials to transform them into a sellable product, you need to add their wages to the WIP account.

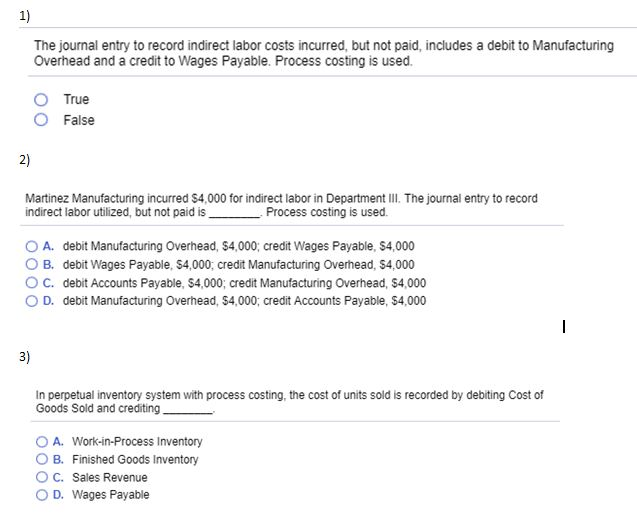

The company can make the journal entry for direct labor and indirect labor that incurs during the period by debiting the labor cost account and crediting the wages payable account and the payroll taxes payable account. In the accounting of job order costing, the labor cost account is usually used for recording the labor cost that incurs during the period including both job costing for construction direct labor and indirect labor. And then this cost will be transferred to the production in order to add up to the cost of units being produced which is usually called work in process. As a small business owner, it’s important to set the prices of your services and product high enough to cover your production costs, turn a profit, and still remain competitive.

Managers use the information in the manufacturing overhead account to estimate the overhead for the next fiscal period. This estimated overhead needs to be as close to the actual value as possible, so that the allocation of costs to individual products can be accurate and the sales price can be properly determined. Manufacturing overhead includes indirect material, indirect labor, and other types of manufacturing overhead. It is difficult, if not impossible, to trace manufacturing overhead to a specific product, and yet, the total cost per unit needs to include overhead in order to make management decisions. Indirect labor costs are the salaries and wages that a business pays to the employees who are not directly involved in the production of goods and performance of services.